QR Payments Loosing Ground

I am a fan of QR payments. Not because there is anything special about the technology, but because it returned competition to the payment market.

QR payments wrestled the true meaning of the word “open” from the so-called “open-loop” systems, which are as open to new players as the Berlin Wall was to the citizens of East Germany.

Unfortunately, some of the main beneficiaries of the new market have grown complacent and seem to think that their success has made them invulnerable to the old, card-based systems fighting back. GCash, the largest consumer-side player in the e-wallet market in the Philippines, is an unfortunate case in point (also see my post on the GCash user experience).

GCash, Nice to have known you

For a while I have observed a strange fraying of the edges of the GCASH business which still commands a large market share in e-wallet accounts.

For a long time there was no stoping the success of GCash. The name became synonymous with QR Payments, and even today most people will ask for Gcash payment even so they are using QRPh.

However, Gcash seems to be loosing ground. I outlined the reasons for this decline more generally in another post.

But there is also the lack of focus on the strength of QR payments in the GCash user experience, which is the topic of this post.

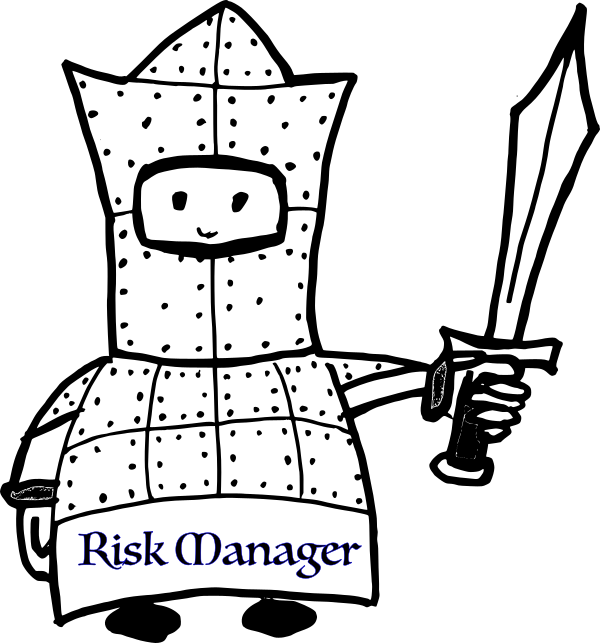

Quo Vadis, Risk Management

Payment professionals seem to have this idea that they are the knight in shining armor who is standing between the clueless and childlike customer and the omnipotent criminal. In their pursuit of safety for everybody, they seem to be willing to sacrifice privacy, self-determination and individual responsibility one small step at a time.

I say that customers are perfectly capable and willing to take responsibility for their actions, and they should bear the consequences of their actions instead of hiding behind the bogeyman of the criminal who, in the imagination of the risk managers, keeps getting ever more sophisticated and smarter every year. By now, all these online criminals must be geniuses that would make Prof Moriarty look like an amateur.

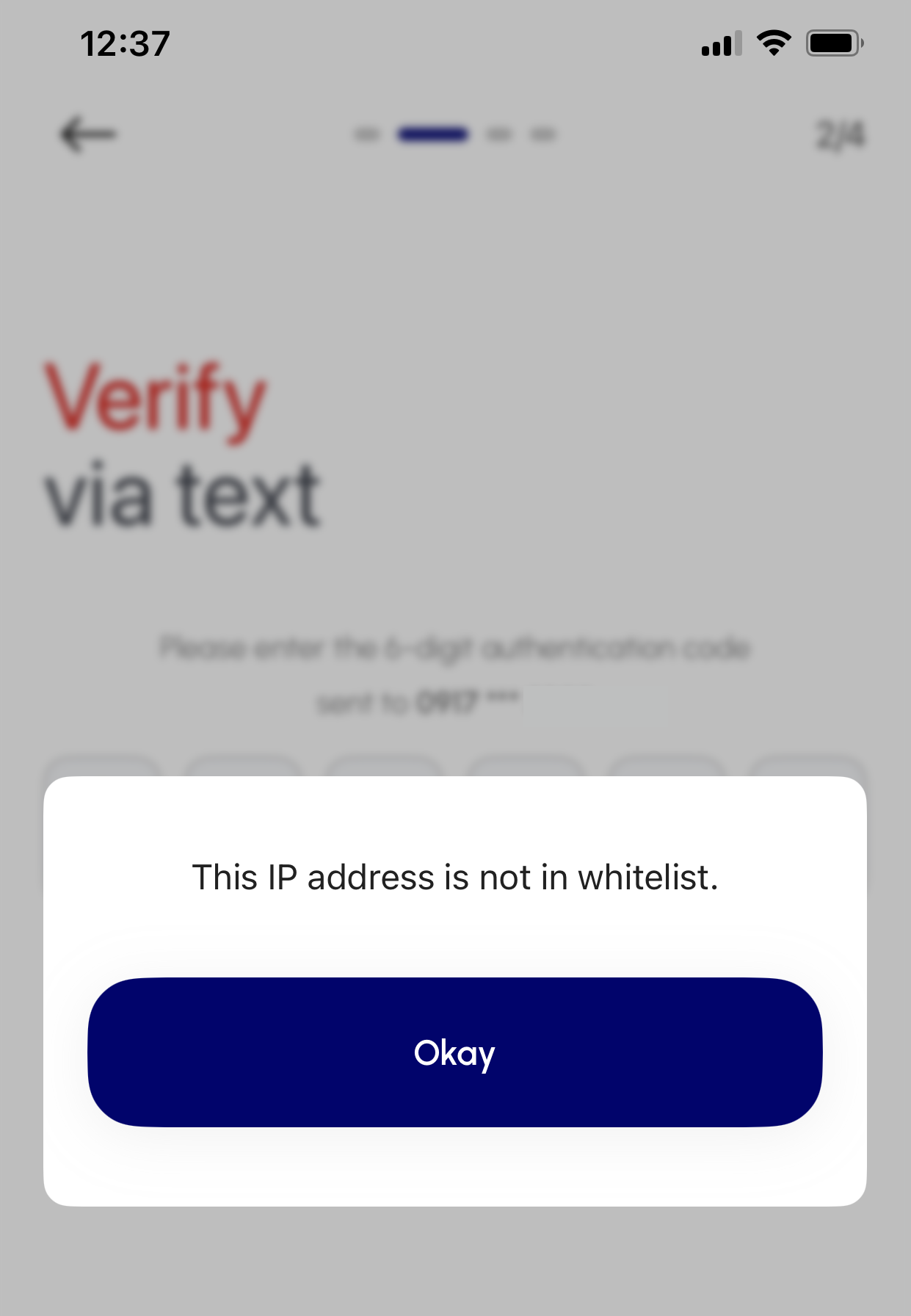

MannyPay - Manny Open Questions

Competition is good, and any open and interoperable payment system should make it easy for new players, small and big, to join. In this spirit, I am happy that another e-wallet has entered the market: MannyPay.

To satisfy my curiosity, I downloaded the app on my iPhone and tried to enroll. Unfortunately, I did not manage to get past a nonsensical error message, and the app froze on the screen where you are supposed to enter a passcode from a text message (which also never arrived).

Nevertheless, I have some initial comments, and I will update this post when they have fixed their teething issues.

Interchange and Surcharge

QR Payments - Innovate, don't imitate!

Instead of innovating payments, the new breed of QR/A2A payment schemes too often think of their system as a “primitive” form of card payments. Or, they treat payment merely as an enabler for their ambition of becoming a virtual bank. There is too much data, too much functionality and not enough effort to make the payment process better.

In this post, I want to make the case for removing data from QR payments.

In my view, the principles of any new payment system should be: “Payment moves money efficiently, anonymously and conveniently (for the customer). Use of account information is kept to a minimum. There should be no personal data.”

InstaPay or P2P QRPh? What is it?

In my previous post, I voiced my opinion that many merchants use their personal GCash account to accept payments. At that time, I was thinking of the proprietary GCash QR code that would only work for customers who use their GCash wallets. More recently, I noticed personal QR codes that seem to work with all e-wallets and mobile banking applications. I tested this specifically with the BPI banking application and the GCash wallet.

Have I found the P2P QRPh?

In this post, I am analyzing the data and the formatting that is used for the P2P QR code. If you are curious, you can also run your own QR codes through my QR Decoder.

AFCS in the Philippines - Why no progress?

The Jeepney and city bus modernization program has been in place for many years. This program also included a mandate for automated fare collection. And still, there has been no progress. Automated fare collection in most mass transit systems in the Philippines is non-existent.

In this article, I will tease out some of the reasons for this state of affairs. I will focus on Jeepneys and city buses.

The light rail systems in Manila and the planned subway or long distance train lines have very different problems, which I might look at in a future post.

Decode that!

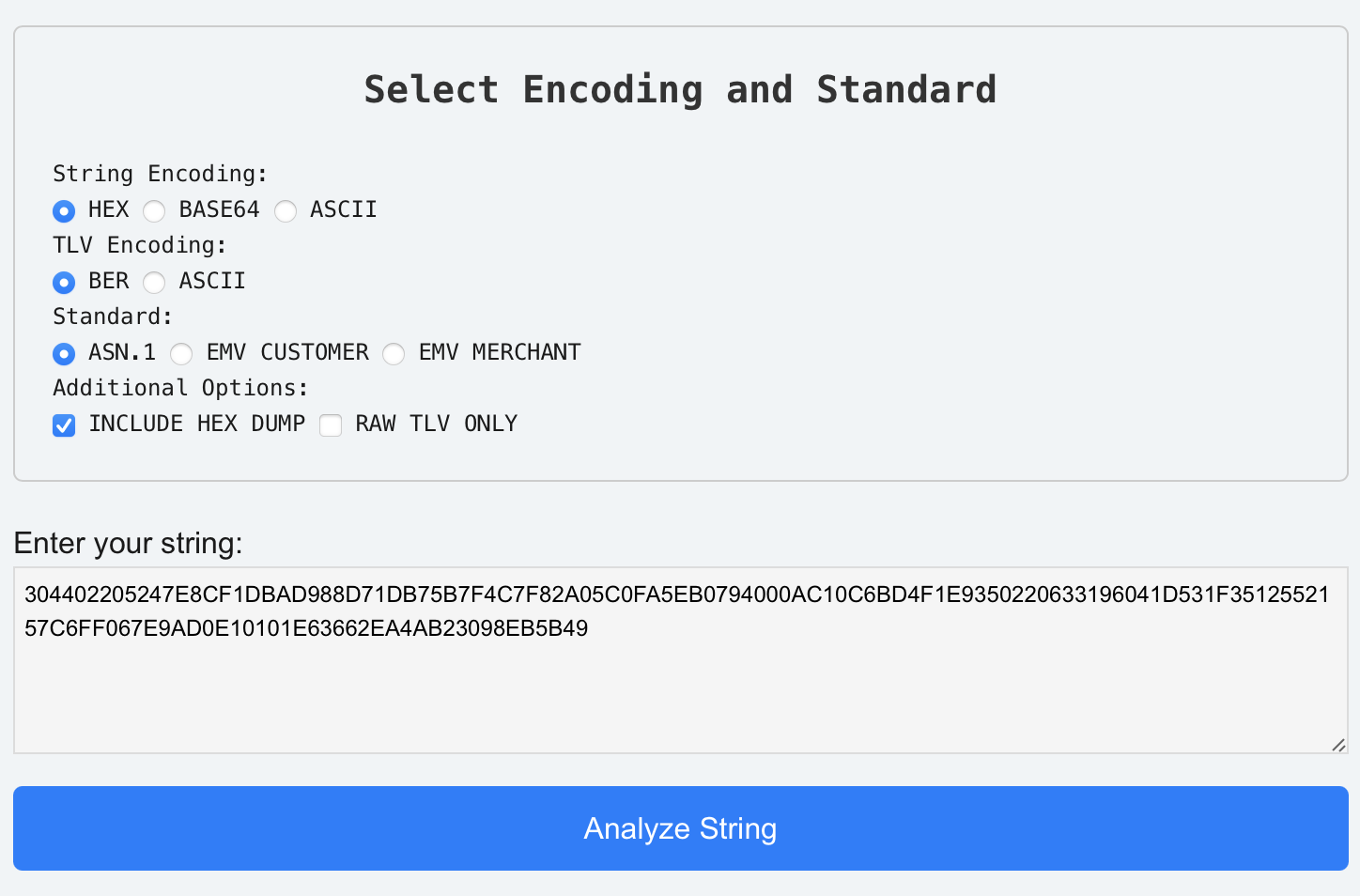

Check out my feeble attempt of writing my first Javascript*. The script looks into the data of QR codes and shows the content in human-readable format. It understands a bit of generic ASN.1, EMV and some other standards that are built on top of the EMV standards, for instance, QCAT, GCASH Transit and QRPH.

If you have any fare collection or payment QR code, you can find out what data it contains. Please consider sending it to me for further improvement of this little javascript app.

(* I cheated a bit and used Kotlin/Multiplatform, but still …)

You can find the source code on Github.

The State of Fare Collection in the Philipines in 2025

Let’s review what public transport systems are available in the Philippines and how the fare is currently collected.